Employee Sponsored:

Most people buy health insurance through an employer or a “group” plan. This can be your employer or your partner/spouse’s employer.

77% of Americans are confused by health insurance terms. These terms are universal when it comes to healthcare coverage. Understanding them can help prepare you when choosing a plan and knowing how to use it.

Health insurance helps you pay for medical care when you have an illness, injury or seek preventive services that are important checkpoints to keeping you healthy. There are several types of plans you can choose and each one has a different amount that you and the insurance company will pay. You can purchase health insurance for yourself or you can get a family plan and cover your spouse, domestic partner and children.

Preventive visits

Vaccinations

Specialist visits

Hospitalization

Behavioral health/mental services

Pregnancy, maternity and newborn care

Prescription drugs

Emergency room visits

Lab work

The time you select/register for a plan is called Open Enrollment Period (OEP).For Medicare, it’s called the Annual Election Period (AEP).

Although Open Enrollment can occur at any time of the year, it typically occurs at the end of the calendar year. You will choose your plan to start January 1 the following year. For Medicare and the Annual Election Period, you choose your plan between October 15 through December 7.

Changing marital status

Starting work with a new employer

Losing other health insurance coverage

Moving to a new state

Having a child or adding a dependent

Qualifying for Medicaid or CHIP (Children's Health Insurance Program)

Most people buy health insurance through an employer or a “group” plan. This can be your employer or your partner/spouse’s employer.

Individual plans are available to everyone through the government marketplace (healthcare.gov) established by the Affordable Care Act.

You can also purchase individual plans through privately owned health insurance companies.

Medicare is a federal program designed for people who are 65 and older and young people with disabilities.

Medicaid provides health coverage to millions of Americans, including eligible low-income adults, children, pregnant women, elderly adults and people with disabilities. Medicaid is administered by states, according to federal requirements. The program is funded by the federal government.

Health insurance is used for basic wellness in addition to managing chronic conditions, men’s/women’s health, pediatric care and other high risk health issues. It allows you to join with a larger group of people (your company or groups of individuals) and pool your money together to spread out the risk of large healthcare costs.

Even as a completely healthy individual it is important to get routine check-ups to help prevent future health issues from arising and to prevent future medical bills that could get expensive.

Planning for the unexpected and having health insurance can give you security when an emergency arises.

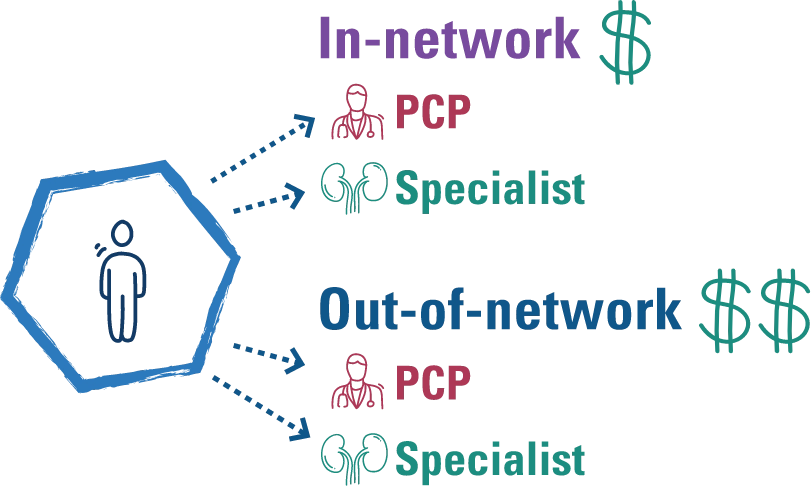

Your network consists of a group of doctors, hospitals and other healthcare professionals who have agreed to provide medical services to members of a healthcare plan for a certain price. Arkansas Blue Cross and Health Advantage create a comprehensive statewide network to ensure strong coverage for you, while making sure every medical provider and facility agrees to certain discounts that make care more affordable for you.

Doctors, hospitals and other healthcare providers that have agreed to provide medical services at set prices with your health plan. This will be the discount shown when you get an explanation of benefits for a visit.

Doctors, hospitals and other providers who have not agreed to set prices with your health plan.

To save money, you will typically choose an in-network provider because Arkansas Blue Cross has negotiated what their services will cost. Out-of-network providers usually charge more. If you receive care from a doctor or hospital that is out-of-network you won’t get the negotiated price (meaning you will pay more out-of-pocket).

Health insurance works by splitting the cost of healthcare between an individual and the insurer to pay the provider. If you hit your maximum out-of-pocket amount for a specific year, your insurer will pick up 100% of the cost.

Prior to receiving healthcare, you will show proof of insurance to your provider. This will tell them what kind of coverage you have and how to bill or charge you for your visit. The amount you are billed depends on many things such as:

Plan type

Deductible amount

In-network or out-of-network care

Premium, copayment, deductible, coinsurance and out-of-pocket maximum. These are all commonly used words in the world of health insurance that can be confusing. What do all these words mean and how do they work together?

Premium is the amount you pay each month for your health insurance coverage even if you don’t use it. It’s your monthly bill for your health insurance, similar to a monthly payment for car insurance.

$150

This is the fixed amount you pay, usually at the time of a medical service. Some plans do not have a copayment for visits*. Usually, copayments are separate from and do not count toward your deductible amount. They do count toward your out-of-pocket maximum, which can help if you have high medical expenses during a calendar year. Your copayment can vary, depending on the type of service you receive (for example, a copayment for seeing a specialist may be more than a copayment for a PCP visit. You also may have a copay with prescriptions.

$40

Deductible is the amount you pay for medical costs before your health insurance begins to make payments to providers for services. Your insurance provider will have certain things that are considered allowable charges to go towards your deductible. They also have different deductible amounts for in-network and out-of-network services

Example:

In-network specialist visit:

$100

This is the percentage of the cost you are responsible to pay. Once you meet your deductible, your insurance begins to pay a majority of your in-network visits and you may pay 20% and they pay 80% (exact percentages depend on your provider and plan). Sometimes the health plan pays 100% of coinsurance once the deductible is met.

Example:

In-network hospital visit:

$500

Most plans have an out-of-pocket maximum, meaning once you pay the set amount, your insurance will cover 100% of any further eligible healthcare expenses. The out-of-pocket limit includes your deductible, coinsurance and copay amounts. The out-of-pocket limit does not include premium payments or charges for services that are not covered.

For example, if your out-of-pocket maximum is $3,000, when you reach this amount, your insurance will cover everything else at 100%.

Example

In-network specialist visit:

$200

*Prices are to be used as an example and can vary. Figures are based on individual plans with no dependents.

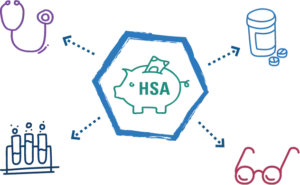

There are special accounts you can use toward medical expenses and prescription: health savings accounts (HSA), flexible spending accounts (FSA) and health reimbursement arrangements (HRA). These accounts let you save and use tax-advantaged money to cover qualified medical expenses. HSA accounts rollover year to year while FSA and HRA accounts must be used before the end of the year.

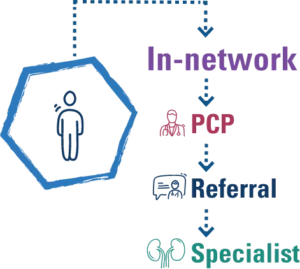

With this plan, you choose a PCP who coordinates your care using doctors and hospitals that are in your plan’s network. If you need a specialist, such as a cardiologist, a referral from your PCP is required. Generally, an HMO won’t cover services from an out-of-network provider.

An HMO plan will usually have a lower monthly premium and deductible, but include coinsurance and copays.

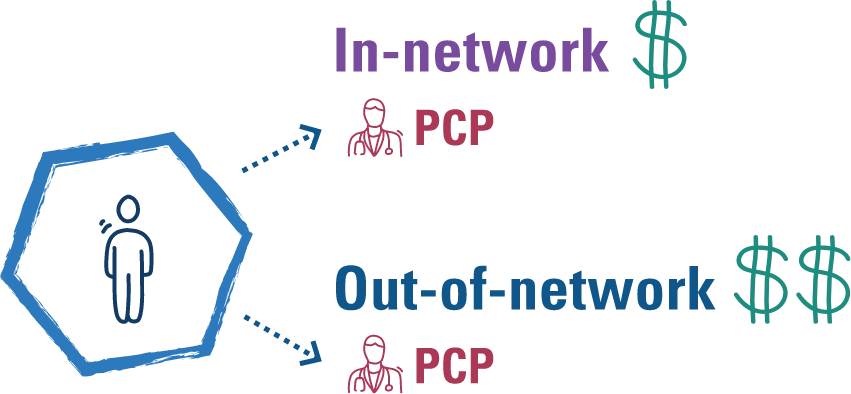

This plan allows you to manage your own care, with or without referrals from a PCP.You have a choice in which provider to see, although you’ll save money if you remain in network.

A PPO will likely have higher premiums than other types of plans, but lower copays and coinsurance.

A POS is a combination of HMO and PP. Like an HMO, you choose a PCP. But like a PPO, you can get medical care from both in- or out-of-network providers. You’ll pay less when you use a doctor or hospital in-network and more if you choose out-of-network.

A POS plan may require you to pay a higher premium and have copays, but most have no deductible for in-network services referred by your PCP.

This plan gives you the most control on how your healthcare dollars are spent. A HDHP has a higher deductible, but a lower monthly premium and a special HSA account to help you save money for healthcare expenses.

HDHPs typically have lower premiums, but you will pay more out-of-pocket for healthcare. Most HDHPs pay for several preventive care visits, but you will pay out-of-pocket for other types of care and prescriptions at the contracted amount set by your insurance and provider.

Arkansas Blue Cross will send you a member ID card once you’ve enrolled in your plan and your coverage has started. This includes the essential information you need to know about your coverage, payment amounts and customer service phone numbers. Each provider you visit will need to make a copy of your ID card to make sure they bill correctly. Always carry your ID card with you in your wallet.

You also have access to a digital ID card on Blueprint Portal. Download the app to have your ID card anywhere you have your phone.

Your card may look slightly different than this example, depending on the health plan you have.

For more information, select a number

Disclaimer: Your card may look slightly different or have different information

1

Helps us identify who you are, the type of plan you have and how your claims are paid.

2

Used by the pharmacy to determine what’s covered, apply your discount and file your claims

3

How much you pay for your prescriptions depending on their type

4

Used to check your plan’s benefits

5

How much you pay for medical expenses before the health plan begins to pay for some covered services

6

How much you pay for a doctor visit, depending on the type

7

How much of your medical bill you must pay after meeting your deductible

8

Lets us know what kind of coverage you have

9

Represents access to national BlueCard® network (

see Find Medical Care Quickly for more information)

Different plans have their own set of prescription drugs they cover. The list of drugs your plan covers is called a prescription drug list (PDL) or “formulary.”

When researching what medicine is covered by your plan, you may see there are tiers. Drug tiers represent different levels of cost and can save you money on your medications. You pay the least for medications in tier 1, which usually are generic drugs.

Generic non-specialty drugs

Lowest plan member copayment.

Preferred, brand-name products

Intermediate plan member copayment.

All non-specialty, non-preferred, brand-name products

Higher plan member copayment.

Specialty medications

Highest plan member copayment.

What about the other stuff? Dental, vision, life and disability are all additional insurance products you can get with your health insurance. If you are getting your health plan through your employer, they will usually have options for you. There are individual options too through privately owned companies as well as government resources.

Health insurance is not just for people with chronic health conditions or expensive situations. Having health insurance gives you access to healthcare at a lower cost than if you were uninsured. Even if you do not have health issues you are aware of, taking advantage of preventive care can allow you to get ahead of unplanned circumstances and make sure you are maintaining your health. Now that you know a little more about the basics of health insurance, take that important first step by finding a PCP in Blueprint Portal (link to BP) and scheduling your annual wellness exam.

Visit us online at arkansasbluecross.com or call the customer service number on the back of your ID card.